The Essential Checklist for First-Time Home Buyers in the UK in 2023: What to Know Before Making a Purchase

Knowing Where to Start your Property Search

Buying a property for the first time can be an overwhelming experience. The journey starts long before you step foot inside a potential new home. It begins with knowing where to start your property search. Online portals, estate agents, property auctions, new-build property developers, and relocation specialists are all potential places to start. Understand the pros and cons of each and decide which route is the best fit for your goals and circumstances.

Understanding your Budget and Funding your Purchase

Once you’re ready to start viewing properties, it’s important to have a clear understanding of your budget. Property prices in the UK can vary greatly depending on location, size, and condition. Remember, obtaining a mortgage pre-approval will be advantageous as it provides a clear picture of what you can borrow and the price range you can comfortably afford. More importantly, it shows the sellers that you are serious and ready to purchase.

Consulting with Property Professionals

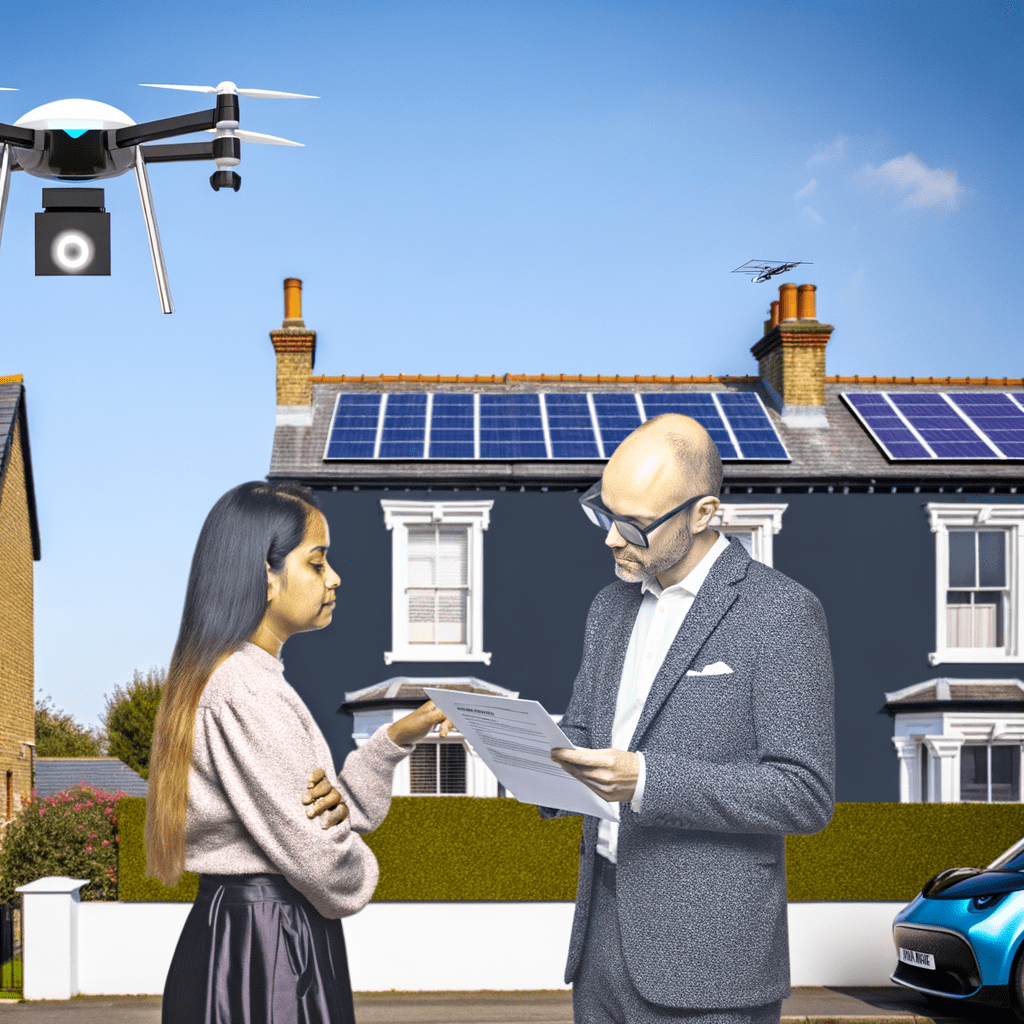

Buying a property is a complex process, hence, surrounding yourself with experienced property professionals is essential. Property lawyers can help with the legalities, while surveyors can help determine the condition of the property. Reputable mortgage brokers, estate agents, and financial advisors can also provide valuable assistance throughout the process.

Location, Location, Location

When looking at properties, remember the old adage – location, location, location. This not only pertains to the city or town but also the specifics like the neighbourhood, proximity to good schools, transportation links, amenities, and even which way the property faces.

Selecting the Right Type of Property

For first-time buyers, deciding on the type of property to buy can be daunting. Whether it’s a flat, a terraced house, a semi-detached home, or a detached house, understanding the implications and responsibilities that come with each can help make an informed decision.

The Importance of Property Surveys

A property survey is a crucial step in the home buying process. It can uncover any structural problems, maintenance needs, and other issues with the property that could potentially be costly down the line. Remember, cosmetic changes can be easily made, but underlying issues like structural damage or damp can be very expensive to rectify.

Making an Offer and Navigating the Conveyancing Process

Once you find a property you love, the next step is making an offer. If accepted, you will then go through the conveyancing process. This involves legal work, including title transfer, deed preparation, and contract review, ensuring that you become the lawful owner of the property.

Understand the Costs Associated with Buying a Home

Lastly, it’s very important to remember that the cost of the property itself is not the only financial consideration when buying a home. There are costs associated with the process including legal fees, survey costs, Stamp Duty Land Tax, removal costs, and more. Be sure to factor in the running costs of owning a home as well, such as utility bills, council tax, Internet and TV license fees, insurance, and maintenance costs.

At Flettons, we’re committed to safeguarding your investment. When considering a property purchase, trust our seasoned expertise to reveal any hidden threats. For a thorough building survey, get your instant quote through our quote calculator or reach out directly at 0203 691 0451. Your home’s safety is our top priority.

——————————————————————————————–